Rev Up Your Finances: Pro Tips for Motorcycle Loan Calculations – In the world of motorcycling, the thrill of the open road beckons to many enthusiasts. Whether you’re a seasoned rider or a newcomer to the scene, the prospect of owning your dream bike can be exhilarating. However, before you hit the road, it’s crucial to understand the financial implications of purchasing a motorcycle, especially when it comes to obtaining a loan. In this guide, we’ll explore pro tips for navigating the complex terrain of motorcycle loan calculations, helping you make informed decisions and rev up your finances with confidence.

Understanding Motorcycle Loans

Before delving into the specifics of loan calculations, let’s first understand what motorcycle loans entail. Similar to auto loans, motorcycle loans are a form of financing provided by lenders to facilitate the purchase of a motorcycle. These loans typically come with varying terms, interest rates, and repayment options, depending on factors such as the borrower’s credit history, the loan amount, and the duration of the loan.

Assessing Your Financial Situation

Before embarking on your motorcycle loan journey, it’s essential to conduct a thorough assessment of your financial situation. Take stock of your income, expenses, and existing debts to determine how much you can comfortably afford to allocate towards loan payments each month. Remember to account for additional costs such as insurance, maintenance, and registration fees when budgeting for your motorcycle.

Researching Loan Options

With a clear understanding of your financial standing, it’s time to research loan options available to you. Start by exploring different lenders, including banks, credit unions, and online lenders, to compare interest rates, loan terms, and eligibility requirements. Additionally, consider seeking pre-approval for a loan to gain a better understanding of the financing options available to you before shopping for a motorcycle.

Calculating Loan Payments

One of the most critical aspects of obtaining a motorcycle loan is calculating your monthly payments. This involves factoring in the loan amount, interest rate, and loan term to determine the total amount you’ll repay over the life of the loan. Fortunately, there are several tools and resources available online, including motorcycle loan calculators, which can help simplify this process.

To calculate your loan payments, you’ll need to input the following information into the loan calculator:

- Loan Amount: The total amount you’re borrowing to purchase the motorcycle.

- Interest Rate: The annual interest rate charged by the lender, expressed as a percentage.

- Loan Term: The duration of the loan, typically measured in months.

Once you’ve entered this information, the loan calculator will generate an estimated monthly payment based on the parameters you provided. This figure will give you a clear picture of how much you can expect to pay each month towards your motorcycle loan.

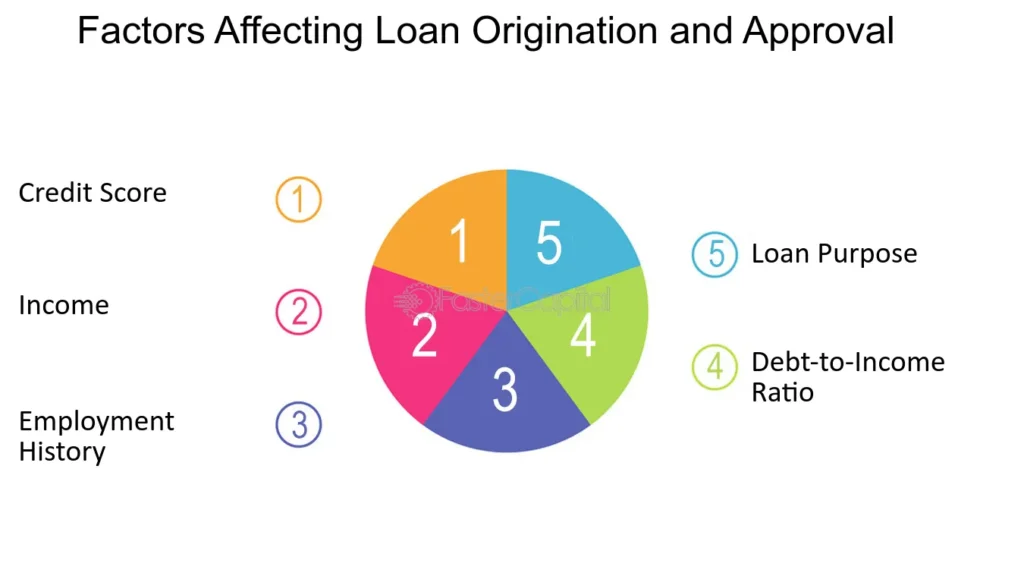

Factors Affecting Loan Calculations

Several factors can influence the outcome of your loan calculations, including:

- Credit Score: Your credit score plays a significant role in determining the interest rate you’ll receive on your motorcycle loan. Generally, borrowers with higher credit scores are eligible for lower interest rates, resulting in lower monthly payments.

- Down Payment: Making a larger down payment upfront can reduce the overall loan amount and, consequently, lower your monthly payments. Consider saving up for a substantial down payment to minimize your financial burden in the long run.

- Loan Term: The duration of your loan term can impact your monthly payments significantly. While opting for a longer loan term may result in lower monthly payments, it also means paying more in interest over the life of the loan. Conversely, choosing a shorter loan term can lead to higher monthly payments but lower overall interest costs.

- Negotiation: Don’t be afraid to negotiate the terms of your motorcycle loan with lenders to secure the best possible deal. Whether it’s negotiating a lower interest rate or requesting additional perks such as flexible repayment options, exploring your options can help you save money in the long run.

Tips for Saving Money on Motorcycle Loans

While obtaining a motorcycle loan is a significant financial commitment, there are several strategies you can employ to save money and minimize your expenses:

- Improve Your Credit Score: Work on improving your credit score before applying for a motorcycle loan to qualify for lower interest rates and better loan terms.

- Shop Around: Don’t settle for the first loan offer you receive. Shop around and compare loan options from multiple lenders to ensure you’re getting the best deal possible.

- Consider Used Bikes: Purchasing a used motorcycle can be a more affordable option compared to buying a brand-new bike. Explore pre-owned motorcycles in good condition to save money on your purchase.

- Pay Off Debt: Reduce your existing debt burden before applying for a motorcycle loan to improve your debt-to-income ratio and increase your chances of securing favorable loan terms.

- Refinance: If you’re already paying off a motorcycle loan with high-interest rates, consider refinancing to lower your monthly payments and save money on interest costs over time.

Conclusion

Navigating the world of motorcycle loans can be a daunting task, but with careful planning and consideration, you can make informed decisions that align with your financial goals. By understanding the factors that influence loan calculations, researching your options, and implementing money-saving strategies, you can rev up your finances and hit the road with confidence aboard your dream bike. Remember to consult with financial professionals and lenders to explore all available options and secure the best possible loan terms for your motorcycle purchase. Happy riding!